Susan Rice has just completed her visit to Beijing to prepare for Obama’s November visit. She arrived as the envoy of the President of the Indispensable Nation and was greeted at the very highest level by Xi Jinping himself, president of one of the many Dispensable Nations.

Susan probably conceives this as an advance visit in more ways than one since Beijing is the final scheduled stop on the U.S. Empire’s march through Eurasia – after sacking Iraq, Libya, Syria, Iran and Russia. Or so the plan goes.

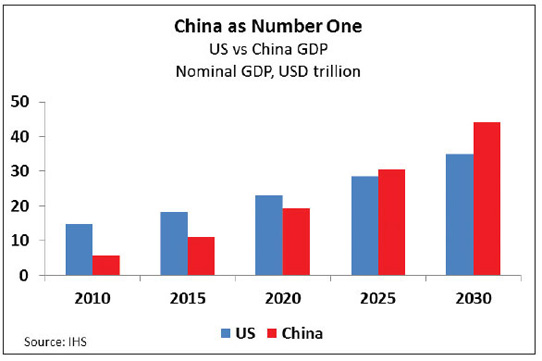

But Rice might surely was given considerable pause on her visit. Just as she arrived China Daily, the English version of which was surely dropped outside her door in the morning, carried a front-page story, headlined: "China ‘largest economy’ by 2024." And with it was carried the striking graphic:

Reader, take note of the phrase "Nominal GDP." This means GDP in real dollars. The alternative measure and the one more often used is given in terms of PPP (Purchasing Power Parity), which corrects the value of the dollar for purchasing power from country to country. By the PPP measure China is already the equal of the US or will be so within a year’s time according to the World Bank.

In my recent visit to Beijing I was given some lessons in PPP. For example a one-hour to trip in a very comfortable taxi as a solo customer to the airport from downtown Beijing was approximately 15 US dollars. In NYC, the equivalent taxi ride would cost roughly 75 US dollars sans tip. (The Chinese do not expect tips and often will not take them.) The PPP measure is important, because it indicates how much some very important things to those with Susan Rice’s mindset would cost in China – like a soldier’s salary or a submarine.

But "nominal" GDP equality as shown in the graph above paints an even more stunning picture of China’s rise since it is given in absolute dollars not relative ones. Moreover, this prediction came not from the Chinese government but from the highly respected US firm of IHS Inc., headquartered in Colorado and"one of the top 10 Scientific, Technical & Medical (STM) Information companies in the world."

If Susan had continued with her complimentary China Daily, she would have read: "’Over the next 10 years, China’s economy is expected to rebalance towards more rapid growth in consumption, which will help the structure of the domestic economy as well as growth for the Asia-Pacific as a region,” Rajiv Biswas, IHS’s chief economist for Asia-Pacific, said…" Biswas continued, ‘The transmission effects of the strong growth in Chinese consumer demand are already being felt throughout the APAC (Asian PACific) region. Rapid growth in Chinese consumption drives demand for exports of commodities, manufactured goods and services from other APAC countries to China, with ASEAN (Association of Southeast Asian Nations) countries expected to be major beneficiaries of the growth in Chinese consumption.’’

IHS expects China’s GDP to be 20% of the world’s total by 2024 which is about the percentage the US now holds, a percentage that is declining as that of the non-Western nations contributes a greater share. Biswas added: "”Science, technology and innovation, these are some of the key sectors that will be crucial in helping to transform China’s economy from the low-cost manufacturing, export-driven economy of the past three decades into a higher value-added economy driven by domestic consumer demand. In 2025, if we were to take a global economic snapshot, China’s economy will play an even bigger role as a key driver of global trade and investment flows."

Simply put, the great economic engine of the planet is now in East Asia, with China at its heart. Now consider how the nations of the region must view the US alternative to China, the Trans Pacific Partnership which would pair those nations with the US, a stagnant economy, and Japan, a declining economy. Which side to choose? That question gives a whole new depth of meaning to the phrase "no brainer." One might also ask why should Russia cling to Europe and the West when the dynamism and wealth creation now lies to the East. All this is not lost on Russia. The disaster that was the Sino-Soviet split is not likely to recur in the form of a Sino-Russian split, and that is due in no small part to US policy.

As Rice looked a little farther into her China Daily, she would have found some news that might cheer her up, if she did not think too deeply on it. This piece was headlined "China’s Poverty Cut Off Too Low: Expert." It would certainly surprise anyone who thought that self-criticism was to be found "only in America." The article reports that China has more people living in poverty than was thought, according to Wei Shanghan of the Asian Development Bank. So while China now has a middle class of 400 million, exceeding the entire US population, it also has another 400 million in poverty. And although Mr. Wei states, “China’s achievement in poverty alleviation is the largest in the world" (in fact in world history), much remains to be done. Wei urged the Chinese government to foster the development of social insurance and subsistence security systems that are accessible to the poor.

Rice might rejoice at this new found weakness in the target of Obama’s Asian pivot, but she would be mistaken. China’s goal is to get rid of all that poverty, and as its record shows, it is deadly serious about that. (The US press would put that another way. It would contend that the Chinese leadership does all that only out of fear of losing its governing role. You see only the Indispensable Nation and a few of its allies act altruistically or patriotically.) And as that 400 million escapes poverty in the coming years, the Chinese market will grow much larger and Chinese economic power will grow mightier.

Perhaps it is time for Rice, her boss and their clique to think more about the Chinese idea of win-win among nations and less about US domination of the Eurasian land mass. But the prospects for that new thought among the US imperial elite look frighteningly dim right now. Get ready for a rough ride, world.

John V. Walsh writes for the Unz Review, Antiwar.com, CounterPunch.com and DissidentVoice.org. He can be reached at John.Endwar@gmail.com.